Beignets, Bacon & Warren Buffet 🥓

This Week in Review☕: Luxury shoppers have had enough | The first non-tech company to hit $1 trillion | Gen Z is not into saving money at all | Sleeping in on the weekends may be good for you | Travel

Quick Bites:

Finance 💰: And the Oracle of Omaha strikes again.

Warren Buffet had more than just his 94th birthday to celebrate this past weekend.

Buffet's Berkshire Hathaway becomes the first non-tech company to reach a $1 trillion dollars in market cap last week.

Buffet might have a personal net worth of $130+ billion but he usually eats the same breakfast at McDonald's for $3.17 everyday 🍔

$3.17 is a bacon, egg and cheese biscuit, but if the market is down, he ditches the bacon and only spends $2.95

FACTS

Key Highlights, reported by CNBC:

💡Berkshire Hathaway has never been worth more than it is today

💡The conglomerate's Class A shares also topped $700,000 apiece for the 1st time ever

💡Equity portfolio: $300 billion

💡Cash Reserves: $277 billion

💡Over the years, Buffet has expanded his businesses ranging from Geico insurance to BNSF Railway to newspapers.

💡However, it is his sharp stock-picking eye- from some of his greatest bets on Coca-Cola, Apple and Goldman Sachs- that has led Wall Street to crown him “the greatest investor in history.”

“His record is a testament to the power of compounding at a very high rate for a very long period of time"

"He never took a leave of absence”

“He says that he skips to work in the morning. He tackles investing with joy”

Our Thoughts💡: Buffet inspiring us to get rich even at 94 years of age.

Are we rich? Umm.. only on the weekends when the stock market is closed

PS. We NEVER let our portfolio determine our mood. We let our spouse do that.

Health 💊: Long Covid keeps $1 million out of work.

4 years after the pandemic, an estimated 1 million people have left their jobs due to the effects of long COVID, The Wall Street Journal reports.

The symptoms, such as chronic fatigue which can make even simple tasks difficult, affect more than 5% of adults in the US.

Long Covid Diary:

Day 1: We have stocked up on enough non-perishable food and supplies to last us for months, maybe years, so we can remain in isolation and recover our strength to finally beat the long-lasting effects of this godforsaken virus

Day 1+30 minutes: We are at the Supermarket because we want a Twix

In 2020, a bar in our local neighbourhood was delivering entire litres of their premixed margaritas for $15 and you got a complimentary roll of toilet paper and hand sanitizer with your purchase and it really felt like there were just no rules anymore

GOOD TIMES 😏😏

For long COVID sufferers who are back at work, employers have increasingly learned to make accommodations.

Despite, studies showing that vaccination lowers the chance of long covid from about 6% to about 3%, "it's still not going away," warns Rue Dooley of the Society for Human Resource Management.

"People are still reckoning with how to balance their livelihoods and life with long Covid, the chronic condition doctors are still trying to understand."

Finance💼: Gen Z isn't into saving money.

Only 15% of Gen Z regularly puts a portion of their paycheck into a savings account, according to a recent Bank of America survey.

Umm half of the problem of saving enough money is that majority of our politicians were born in the 1930s and they still think rent costs $75 a month 🙄

PS. As a millennial, we personally DESPISE being cliched as lazy, avocado toast eaters who splurge on overpriced coffee all day 😡

Bout time ppl put the spotlight on Gen Z.. Like we see 18-year olds order smashed avocado with crumbled feta & fried eggs on seeded multigrain bread at $30 a pop at our local cafe??? 🥑🥑

Like, how are THEY affording to eat like this? $30 everyday could go towards a deposit on a house, retirement or in a savings account!

Key Highlights, reported by CNBC:

💡Gen Z is typically defined as those born between the years of 1997 and 2012

💡Only 1 in 5 Gen Zers are contributing to a retirement account

💡Living in the Now: Gen Z value spending on things that bring immediate happiness, like travel and new tech, rather saving for the future.

💡Uncertain Future: With the rising cost of living, student debt, and an unpredictable job market, saving can feel like a drop in the bucket.

💡Some feel like they might as well enjoy what they can now because the future is so uncertain

The good news💡: Gen Zers are still under 30, and have plenty of time to save money and develop smart financial habits, CNBC.

“Everyone’s financial situation is different [..] If you focus on yourself and work on what you can control, you’re going to be better off for it. Saving is great, but the discipline around how you manage your money is far better.”

-Douglas Boneparth, a certified financial planner

Culture 💤 : Sleeping in on the weekends may be good for you, research finds.

New research suggests that catching up on sleep may even benefit your heart health, amounting to a 19% lower risk of developing heart disease.

Yeah we don't have that issue in our fam. Our bf had a hard time waking up in the morning so he downloaded this obnoxious sounding alarm on his phone to ensure he wouldn't oversleep.

So far the only people awake from it this morning is us, the dogs and the grandma on the ground floor 🤯

Key Highlights, reported by CNN:

💡Lack of sleep can lead to plenty of heart issues

💡These include high blood pressure, high cholesterol, heart attack, obesity and diabetes

💡Sufficient sleep is also associated with better mental health

💡To promote heart health, it’s recommended to aim for at least 7 hours of sleep each night and maintain a consistent sleep pattern

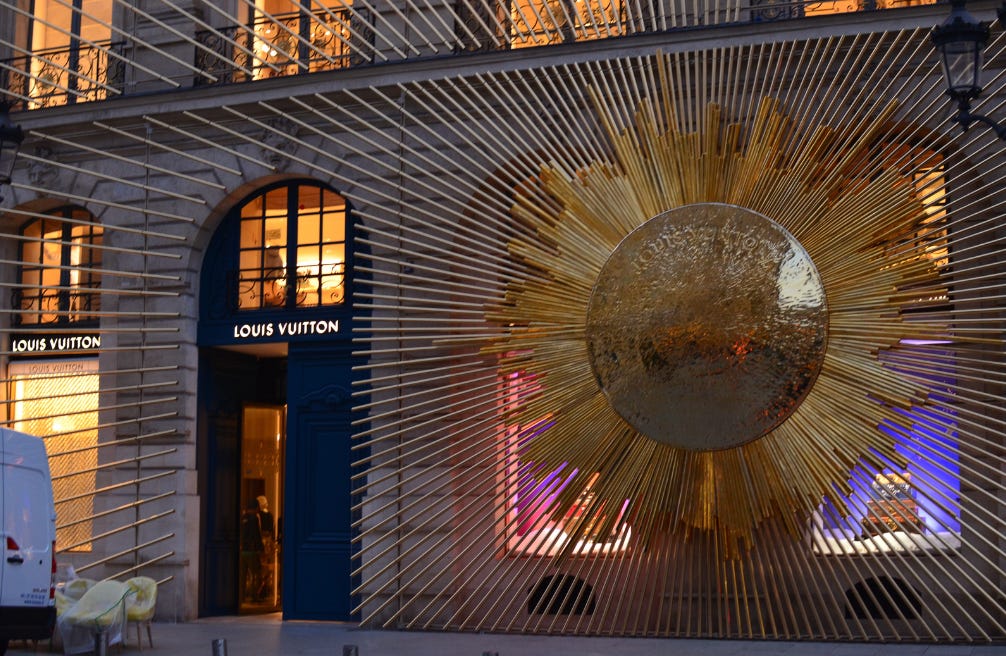

Retail 🛍️ : Move over Hermes. Chinese shoppers turn to designer fakes to save money, Bloomberg reports.

Sales of homegrown designer dupes from Hermes to Lululemon have skyrocketed in China since last year as the country's economic slowdown continues and shoppers search for affordable alternatives.

So maybe the Hermes SAs will finally stop being snooty to whom they sell their Birkins 🙏🏻

Key Highlights, reported by Bloomberg:

💡They are known in Chinese as “pingti” and Gen Z slang as “dupes”

💡The popularity of dupes reflects a backlash against luxury brands among formerly label-loving Chinese shoppers

💡These fakes aren't necessarily cheap either: these local makers sell products at relatively high prices by promising the same quality as top global brands- just without the logos

💡Anti-Status Symbol: Some Gen Zers view fashion more as a form of self-expression than a status symbol. Wearing a fake is a way to say, "I like the style, not the price tag"

💡Social Media Pressure: With the constant need to show off new outfits on social media, it can be hard to keep up with the latest trends. Fakes offer a way to stay stylish without constantly spending on new clothes

💡Access and Availability: The internet makes it super easy to find good-quality fakes, sometimes so convincing that it’s hard to tell the difference

Quicker Bites:

Brazil’s high court upholds ‘X’ ban.

Protestors demonstrate in Israel over hostages deaths.

ByteDance taps banks for $9.5 billion Asia dollar corporate loan, Reuters reports.

Netanyahu stands firm on ceasefire terms.

Virginia Ogilvy, confidante to Queen Elizabeth II, dies at 91.

Polio vaccination campaign begins in Gaza.

Note:

Hi everyone , this Business newsletter is for free BUT:

For those who also also enjoy Luxury Fashion, Travel, Wellness + unfiltered real talk🥰, consider upgrading to our new, exclusive newsletter Touristy Luxe for the price of a cup of coffee.

Your support means more than words can say and most importantly, it will allow us to continue creating content that we can all connect to.

Thanks again for being here 🫶🏻

Team Touristy xx